DMARC policy transition strategies for global banks: Moving to quarantine and reject safely

DMARC has now become a non-negotiable for every organization that sends bulk emails on a daily basis. It is even more critical for banks, where the stakes are so high that it’s not merely about money, but also sensitive data of their customers, regulatory compliance, and the integrity of their brand.

That’s exactly why global banks are such attractive targets for spoofing, phishing, and business email compromise (BEC) attacks. The kind and volume of information that they have in their systems, whether it is identity proofs, loan documents, or transaction records, are all sufficient to lure the cybercriminals into initiating highly sophisticated and well-targeted campaigns.

So, what these banks need is a way to ensure that every email sent under their name is unquestionably authentic. That’s where DMARC comes in, not just as another checkbox in the security stack, but as a policy framework that lets banks decide who can send emails using their name, and what to do with messages that don’t pass the checks.

The thing is, just having DMARC in place doesn’t do the job. Banks need to actually use it the right way by implementing the right policy in place at the right time so that it blocks the fraudulent emails without getting in the way of the legitimate ones.

Now, let’s look at what we mean by “implementing the right policy at the right time” and how global banks can actually do it.

What is DMARC, and what does it do?

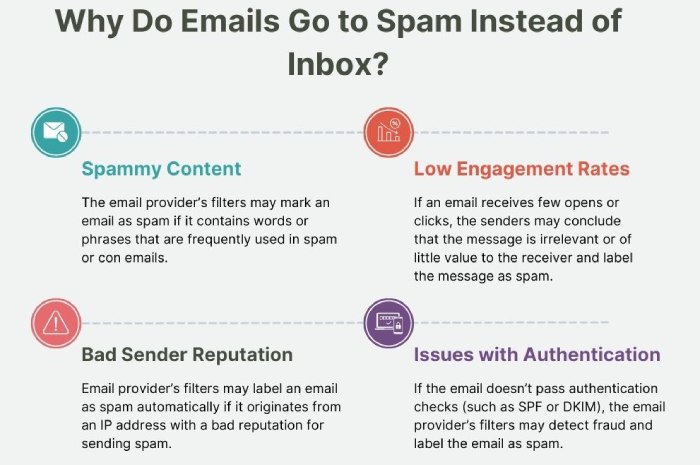

DMARC, or Domain-based Message Authentication, Reporting, and Conformance, is an email authentication protocol that helps domain owners prevent email-based attacks like spoofing and phishing by allowing them to specify what to do with the emails that fail authentication checks. DMARC works in tandem with SPF and DKIM. These protocols serve as the underlying checks; SPF verifies that the email is sent from an authorized server, while DKIM uses a cryptographic signature to ensure the message hasn’t been altered in transit. After an email crosses these two checkpoints, DMARC decides what to do with the emails that fail both SPF and DKIM checks.

The rules of DMARC are simple. Based on the policy you have set, it will either let the email in and simply monitor (“p=none” policy), mark the email as suspicious and usually send it to the spam folder (“p=quarantine” policy), or block the email entirely from reaching the recipient’s inbox with “p=reject” policy.

Apart from this, DMARC also sends regular reports so you can see who is sending emails on your behalf and whether those messages are passing authentication, giving you both control and visibility over your domain’s email activity.

Why does DMARC matter for global banks?

Over the years, the financial sector has become a prime target for cyberattackers. Since email is the easiest way in for attackers, they leave no opportunity to exploit it.

Moreover, with new-age technologies like Generative AI, the threats have become more sophisticated, and it has become easier for attackers to design effective and personalized phishing or spoofing campaigns. As a matter of fact, recent data shows a 25.2% year-on-year jump in advanced email attacks on the financial services sector within one year alone.

That’s why the whole financial industry needs to take email security more seriously, and for global banks, the stakes are even higher. DMARC is one of the best ways to protect the email ecosystems of these banks because it makes sure that only approved senders can use their domain.

Let’s look at why DMARC is so important for banks, not just for protecting customers, but also for staying compliant and keeping trust intact.

Building trust with every email

Most people receive emails from their banks, whether it is about a transaction history, a new service update, or simply a security alert. If even one such email turns out to be fake, it can jeopardize the customer’s confidence in any communication from the bank. DMARC helps prevent this by only allowing genuine, verified emails to be delivered to the customer’s inbox.

Ensuring important emails don’t get lost

Recipients’ emails are already very cluttered and overflowing with marketing and promotional emails. It is very easy for an important message from the bank to get lost in this noise, or, worse, filtered into spam. To avoid this, it is important that these big banks implement DMARC for their email-sending domains. This helps cut through the clutter by blocking fraudulent emails that misuse the bank’s domain, which in turn improves the chances of genuine emails landing directly in the inbox where they belong.

Protecting the bank’s reputation

Global banks like JPMorgan Chase, HSBC, and Morgan Stanley are already big names in the financial sector, but that doesn’t mean they are immune to cybercriminals trying to misuse their names. Even a single phishing email can trick customers into revealing their sensitive information, and this can put the entire bank’s credibility at risk.

DMARC helps protect against this by ensuring that only authorized senders can use the bank’s domain, keeping fraudulent emails out of customers’ inboxes and safeguarding the bank’s hard-earned reputation.

Helping banks stay compliant

Since the stakes are so high in the finance sector, every bank is required to meet certain regulations to protect customer data and ensure secure communication. These include global standards like GDPR, PCI DSS, and new sender rules from Google and Yahoo. The good thing is, DMARC is one protocol that supports these requirements by checking every email sent from the bank’s domain and blocking the ones that fail. This reduces the risk of fraud, legal liabilities, and tells the governing bodies that they take security seriously.

How does DMARC help banks meet compliance rules?

Since banks deal with critical, sensitive data, they are required to follow certain strict standards that protect customer information and secure communications. Here’s how DMARC helps them meet these requirements.

Meeting global data protection laws

Privacy norms like GDPR in Europe and similar laws in other regions are important to protect customer data from being stolen or misused. Since the easiest way to get this information is through email, DMARC helps by checking whether an email is genuine and blocking the ones that aren’t. This reduces the risk of phishing attacks and data breaches, helping banks stay compliant with these privacy rules.

Complying with payment security standards

Transaction emails are a part of everyday banking. But they are also easy targets for cybercriminals who design their fraudulent versions to trick customers into sharing payment details or login credentials. Standards like PCI DSS set strict rules to protect this information. And DMARC helps meet these norms by ensuring that only approved servers can send these emails and by blocking any that are fake, keeping customer payment data safe.

Following the new sender requirements by ESPs

Major email service providers (ESPs) like Google and Yahoo now require every big and small organization that sends more than 5000 emails per day to follow stricter authentication rules. One of their requirements is implementing DMARC, as it helps prove that the emails are genuine and not sent by scammers. For banks, this assurance is all the more important as it protects customers from falling for fake emails, keeps sensitive information safe, and ensures that important messages reach the inbox without delay.

What should the DMARC policy journey look like for these banks?

By now, we know that major global banks need DMARC to protect their domains and customer data, but you’ll be surprised to know that most of these banks are falling behind on the enforcement part. In the UK, only 47% of the 150 incorporated banks have implemented the strictest policy of DMARC. This means more than half of them are still exposed to email-based threats, despite having the tools to prevent them. The real problem is that most of them don’t know how to go about DMARC policy enforcement in a way that strengthens security without disrupting legitimate communications.

The DMARC policy enforcement journey typically moves through the following stages:

Monitor (p=none)

In this policy, the domain owners (banks) just have to watch and learn. They publish a DMARC record with the p=none setting, which doesn’t block or filter any emails. Instead, it collects detailed reports on who is sending emails using their domain, whether those emails pass SPF and DKIM checks, and which senders are failing authentication.

Quarantine (p=quarantine)

Once they are sure that their legitimate senders are passing authentication checks, they can move on to quarantine. Here, emails that fail DMARC are marked as suspicious and sent to the spam folder instead of the inbox.

Reject (p=reject)

After confirming that authorized senders are using the domain, the last phase is the strictest, with a p=reject policy. This policy instructs DMARC to outrightly block suspicious emails. For global banks, this is the ultimate safeguard against domain spoofing; if the fraudulent emails don’t reach the recipient’s inbox because they failed authentication checks, there’s no risk of the customer opening it, engaging with it, or falling prey to it.

Not sure how to approach DMARC policy enforcement for your domain? Get in touch with us today.