In 193 AD, the royal guard killed the Roman emperor. Then the empire was auctioned off to one Didius Julianus in 193 AD. Julianus had paid somewhere around $1 billion in today’s money. Unfortunately, the guards had scammed Julianus by selling something that didn’t belong to them. Julianus was emperor for a few weeks before he was overthrown.

This was one of the earliest and biggest scams in recorded history.

Financial frauds like this still exist but on steroids, thanks to technology. However, modern problems demand modern solutions.

7 Best Ways to Prevent Banking Fraud

Here are seven types of banking fraud and some of the best ways to prevent them.

1. Identity Theft

In the age of the internet, it has become really easy to become someone else online.

Fraudsters use different methods to extract your personal identifying information such as your social security number, date of birth, or credit card number.

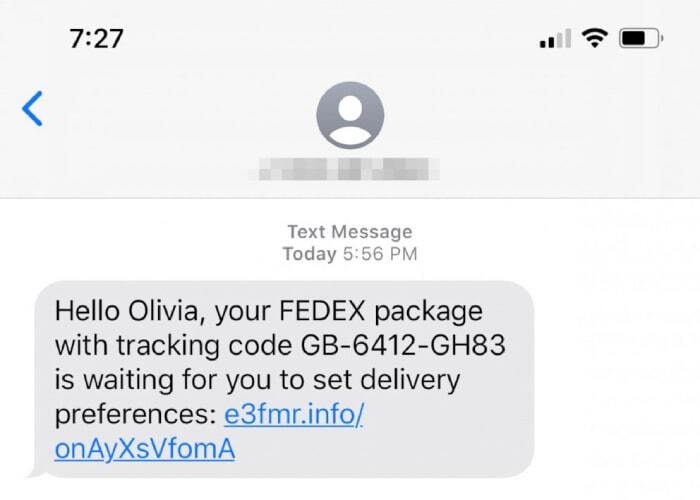

Scammers employ phishing, among other techniques, in which they pretend to be someone from a legitimate organization (e.g. a retail store or your bank) and send a fraudulent message and trick you into revealing your credentials.

This information may include passwords and even your password recovery details.

Preventive measures

- Use powerful and up-to-date security software. Go for an antivirus solution that includes identity theft protection and monitoring capabilities.

- Also, it is important to keep your operating system updated.

- Watch out for phishing scams. Never click on any link that you received through an email, instant message, or social networking site.

- Instead, use a search engine to find the website yourself to ensure you land on the legitimate page instead of a fake landing page.

- Stop malicious emails before they harm you with DuoCirlce’s email security solution.

- Use strong passwords. Weak passwords are easy targets for identity thieves. Avoid using the same password everywhere. Keep your password long.

- Use alphanumeric passwords and use special characters, upper and lower cases to make your password strong.

- Additionally, you can use password managers and multi-factor authentication (MFA) for that added layer of protection.

2. Wire fraud

Today, wire transfer fraud encompasses any bank fraud that involves electronic communication or the internet.

These can include an email, a phone call, a text, and social media messaging. This implies that anyone without much technical skills can target you.

The goal of wire fraud is to extract the victim’s financial information. The scammer will use this information to target the victim’s money.

Most wire transfer fraud involves one-time or infrequent fund transfers (or one without automated mechanisms such as international wire transfers).

Preventive Measures

- Use automated systems designed to detect suspicious or fraudulent activity. Artificial Intelligence (AI) makes it possible to continuously scan data going through a system, flag suspicious transactions, and alert humans to have a closer look.

- Verify the authenticity of wire transfer requests using a multi-step verification process.

- Avoid using public domain email accounts (such as @yahoo.com) for business purposes. Mandate wire transfer requests are sent from company domain email accounts.

- Use two-person authorization (2FA) or segregate duties—if one person receives the transfer request, a second person authorizes the transfer.

3. Banking-Related Cybercrimes

This type of fraud occurs when scammers gain access to and make fund transfers from a person’s online bank account.

Online banking fraud can occur in many ways. The following are three common ways:

Phishing: Scammers use emails to trick victims into sharing personal information, including bank details.

Vishing: Scammers call up potential victims to extract their personal and financial information.

Malware: Scammers use malware to capture your passwords and codes which can then be used to make fraudulent payments from your bank account.

If you want to know more about banking-related cybercrimes, read this article on banking fraud.

Preventive Measures

- Keep financial data separate. For businesses, keep a dedicated system to handle all company banking tasks.

- Once you are done with your banking activity, back up sensitive banking information before you clear your browsing history.

- Never share any personal information via email. Banks won’t ask for personal data like account numbers or social security numbers.

- If you receive an email asking you to provide sensitive financial information—it doesn’t matter it if looks genuine—call to verify before responding.

- Keep your passwords a secret. Change your passwords regularly using a combination of numbers, letters, and special characters.

- In addition to this, use encryption on your network and change your WiFi password regularly.

- Protect your computer. Besides keeping your operating system and browser updated, install antivirus software to secure your computer and network.

- Additionally, installing and enabling anti-spam filters, firewalls, and anti-malware software will help fight malicious online activity

4. Account Takeover (ATO)

ATO is a type of identity theft and usually begins with compromised credentials.

Here, the scammer steals your working online banking username and password to siphon funds out of your account.

They could also access your credentials from the dark web or with the help of phishing attacks.

In the post-pandemic era, many people have shifted from physically offered services to online or cloud services.

Though this provides more connectivity, it also exposes us to online threats. Because of this, the risk of ATO fraud looms bigger than ever.

Another reason why ATO is difficult to detect is that banks try their best not to interfere with their customers’ spending as a way of rewarding trustworthy customers.

This may lead to overlooking suspicious transactions.

Preventive Measures

- A consortium data system stores information from varied sources which is shared among businesses in the same sector/industry.

- Banks should rely on consortium data for fraud prevention. They can create a database of threats or frauds perpetrated on them.

- Automated systems can use these cases to self-train and self-improve and devise effective measures to prevent ATO.

- Additionally, employ MFA or 2FA for an added layer of security to prevent scammers from using stolen credentials to access bank accounts.

5. Accounting Frauds

Accounting fraud primarily targets companies and businesses and affects business lending. This type of fraud involves intentional manipulation of a company’s financial statements to misrepresent the company’s financial health or to hide profits or losses.

Using fraudulent bank statements, businesses may take loans from banks to never repay the loan.

A good example of accounting fraud is the Lehman Brothers Scandals of 2008. It was found that the company hid over $50 billion in loans, which were disguised as sales using accounting loopholes.

Preventive Measures

- Machine learning (ML) uses big data to fight financial fraud by learning from the past. Deploy an ML-based cybersecurity system that can train itself and protect you from new threats and techniques of accounting fraud.

- Avoid letting your bookkeeper reconcile your company’s bank account. The person who pays the bills or prepares financial statements should never reconcile the bank account simply because it becomes easy for them to cover their tracks.

- Close your accounting period once you produce your financial statement. This will help prevent the scammer from hiding a fraudulent transaction in a prior year.

- Additionally, you can scan the bill and link it to each accounting transaction to make it more difficult to fake a bill.

- Automated integrations — such as Amazon and QuickBooks accounting integration — help reduce fraud risks by eliminating manual data entry. When data flows directly from platforms like Amazon into your accounting system, it minimizes errors and makes manipulation harder to hide.

6. Money Laundering

As long as people steal money or illegally acquire it, they will continue to look for ways to legitimize illicit gains. Laundering “cleans” the “dirty” money by passing it through a series of businesses or complex transfers or transactions.

Criminals target banks for whitewashing dirty money. So, banks with poor preventive measures to tackle money laundering are often at risk and may face legal ramifications.

Preventive Measures

- Get rid of legacy systems, which are often outdated and can have loopholes such as physical ledgers and paper trails.

- Therefore, it becomes important to consolidate these outdated systems into a single solution.

- Implement Anti-Money Laundering (AML), which is a set of policies, procedures, and technologies designed to prevent money laundering.

- A robust AML software can detect and prevent criminals from converting illegal funds into legitimate income.

- Keep a “know your client” measure in place. Utilizing data to understand client behavior is one of the most important transaction monitoring rules. The measure can help detect and report suspicious transactions for particular clients and help law enforcement trace the crime back to its source.

7. Card Information Skimming

Card skimming is a type of identity theft that involves the scammer stealing your credit card information or personal data. To do this, scammers install a small device on a real card reader.

It covers all types of banking fraud committed using a credit or debit card with the intent to obtain goods or services or to make payment to another account held by the scammer.

Preventive Measures

- Never lose sight of your card. Make sure that you are the only one to use the card. Do not hand it over to a member or staff.

- Keep your PIN private. Also, cover the keypad while entering your PIN.

- Look out for signs of tampering (e.g. loose or broken parts) while using an ATM.

- Flag suspicious activities. Call your bank, ATM provider, or local authorities if you notice any suspicious activities on your credit or debit card.

- Upgrade your card. Upgrade to a card with chip-and-PIN technology. Microchips will encrypt your data while PIN will ensure in-person verification, thus making it more difficult to carry out fraudulent activities.

Conclusion

With the rapidly evolving online banking landscape, it has become extremely important to keep your personal and financial information protected from cybercrimes.

Also, the dynamic nature of fraudulent activities requires spreading awareness about online scams to effectively prevent banking-related cybercrimes.

Hopefully, this article has provided you with some useful tips and measures to prevent banking fraud.

Author bio

Atreyee Chowdhury works full-time as a Content Manager with a Fortune 1 retail giant. She is passionate about writing and helped many small and medium-scale businesses achieve their content marketing goals with her carefully crafted and compelling content. She loves to read, travel, and experiment with different cuisines in her free time. You can follow her on LinkedIn.