PCI DSS v4.0 and the Role of DMARC in Boosting Security: A Guide

Is the card payment system of your business secure enough to keep cyber predators at bay? Not as much as you think!

There’s no doubt that online transactions have made doing business a lot easier than it ever was, but with opportunity comes a cost. A cost that you have to pay, especially if you are not wary of the ever-evolving cyber-threat landscape.

The truth is, the situation is only getting worse with grave cyberattacks like phishing and spoofing lurking over your unsuspecting customers who trust their sensitive information, like card details, with your payment systems. To protect vulnerable users and maintain the integrity of your transaction processes, the Payment Card Industry Data Security Standard (PCI DSS) version 4.0 is a major update you should know about! Out of all the updates, the one that stands out is the mandatory implementation of DMARC by 2025.

Let’s learn more about it in this article.

Decoding PCI DSS v4.0

The payment card industry has never been secure enough, especially not until 2004 when all the big companies like Visa, Mastercard, American Express, etc., unanimously came up with the Payment Card Industry Data Security Standard (PCI DSS), designed to ensure safe and secure card transactions. After multiple iterations, the fourth edition of these standards— PCI DSS v4.0 was released on March 31, 2022.

The latest version of PCI DSS talks about the following updates:

A Customized Approach to Security

The PCI DSS v4.0 reveals that innovation and security can go hand in hand. With this outlook, it offers organizations that rely on payment systems to implement solutions that fit their specific needs instead of prescribing them a strict rulebook to meet security standards.

Making Authentication a Priority

The latest update to PCI DSS emphasizes the importance of data protection by prioritizing robust authentication methods. This means that your clients’ sensitive information, like their credit card details, will be secure during transactions and when stored. This update aims to make sure that only authorized users can access your information, which reduces the risk of data breaches and fraud.

Emphasis on Continuous Security

The PCI DSS v4.0 recognizes that cybersecurity is no longer about dodging attacks but about building a cyber-resilient ecosystem, which is certainly not a one-and-done endeavor. With this update, the organizations will be compelled to prioritize continuous monitoring and regular updates.

Regular Reporting and Accountability

The fourth version of the security standards aims to make governance and accountability a priority, especially when it comes to handling sensitive customer information. By holding the stakeholders accountable, compliance management is no longer left to chance but is seen as an important task with well-defined processes.

Continuous Risk Assessment and Management

PCI DSS v4.0 stresses following a more dynamic approach that is risk-based instead of static. The thing with a risk-based approach is that it requires you to continuously assess, evaluate, and fine-tune your security practices instead of following a pre-defined template.

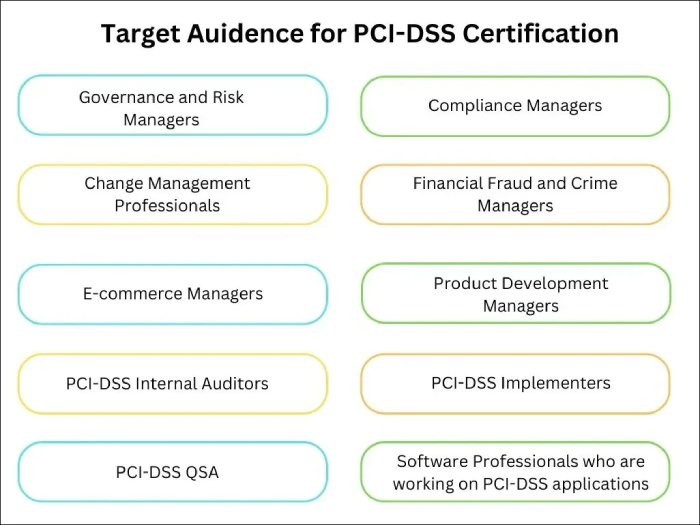

Identifying the Target Audience of PCI DSS v4.0

Since cyber attackers are not too picky about their targets, it only makes sense that the security standards laid out to challenge these attackers should not be limited to a particular sector or group of organizations. That being said, it is recommended that all organizations, including merchants, processors, acquirers, issuers, and service providers, should follow the new set of rules.

The other entities that are a part of the payment ecosystem and should comply with PCI DSS v4.0 include:

- Any entity, be it a company, individual, or a system component that is somehow involved in storing, processing, or transmitting cardholder data, is required to adhere to PCI DSS v4.0

- Businesses, people, or processes that might indirectly impact the security of the Cardholder Data Environment (CDE) should follow the guidelines

- Even if a system component does not directly handle cardholder data (CHD) or sensitive authentication data (SAD) but is connected to systems that do manage CHD or SAD, they ought to comply.

The Role and Relevance of DMARC in PCI DSS Compliance

As we have already mentioned, DMARC implementation is one of the most important updates of the latest PCI DSS v4.0 standards. The reason the Payment Card Industry Security Standards Council places so much stress on this authentication protocol is that the basic premise of the PCI DSS v4.0 is fraud prevention and email security, and DMARC directly aligns with these goals.

Take a look at how!

Enhanced Security Against Phishing Attacks

By ensuring that only those authorized to send emails on your behalf can do so, DMARC can significantly bring down the risk of phishing attacks. This is especially important when sending transaction-related emails because once imposters get in, they are sure to execute nefarious activities in the disguise of your organization.

Improved Email Deliverability

Apart from protecting your systems against phishing attacks, DMARC also ensures that your emails land in the recipient’s inbox, especially if they are important emails like payment alerts or transaction confirmations.

Seamless Regulatory Compliance

Last year, the key players in the email industry— Google and Yahoo set new standards in the cybersecurity realm. Following the same suit, PCI SSC has now taken a similar approach by mandating DMARC deployment by 2025. This means that you can no longer be complacent about your email security measures, or else it will cost you significantly in terms of potential financial penalties, business reputation, and customer trust.

Less Risk of Financial Loss

Implementing DMARC to comply with PCI DSS v4.0 also means mitigating financial risks associated with data breaches, regulatory fines, legal liabilities, and reputational damage. Not to mention, it will also contribute to long-term financial stability by fostering a secure business environment.

With payment frauds expected to reach $40.63 billion by 2027, keeping up with the industry trends is more than just a recommendation; it’s an imperative. Need help ensuring fuss-free compliance? Trust experts at DuoCircle to help you with everything related to DMARC authentication and more. Contact us today to learn more about our services.